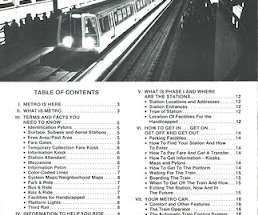

Desperate times sometimes lead to a more marketing-oriented guise: WMATA/Metrorail | Bonus: WMATA's financial crisis

Rebuilding Place in Urban Space

JULY 4, 2023

Now a goodly amount of that is encapsulated in " Branding's (NOT) all you need for transit " (2018), but old pieces like " Making Transit Sexy " (2005), make the point too, less sophisticatedly. First, in the early years of the blog I wrote a lot of pieces about transit marketing and doing a better job of it.

Let's personalize your content