Purple Line Corridor Coalition study: Same Old, Same Old | Gentrification will result from investment in transit infrastructure

Rebuilding Place in Urban Space

SEPTEMBER 29, 2022

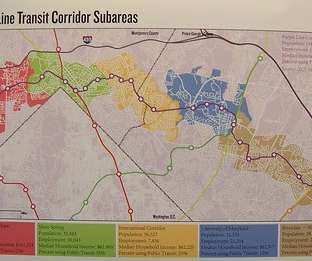

Poster board from the 2014 meetings. The study came from the public-private Purple Line Corridor Coalition, a group composed of government officials, community activists, nonprofits, companies and academics. Communities most at risk include Long Branch, Langley Park and Riverdale Park, study leaders said.

Let's personalize your content