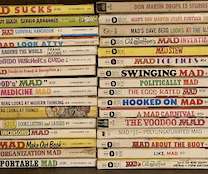

2023 reading list and commentary

Librarian.net

FEBRUARY 10, 2024

I’ve been actively seeking out non-binary authors and trying to read print a little more. average read per month: 9.5 average read per week: 2.2 The always-updated booklist, going back to 1997, lives at jessamyn.info/booklist and it has its own RSS feed.

Let's personalize your content