Building Resilience: Leveraging Innovative Partnerships and Low Cost Capital to Meet Affordable Single-Family Housing Needs

August 25, 2022

This is an excerpt of Chapter 10 of Tackling Vacancy and Abandonment: Strategies and Impacts After the Great Recession, jointly produced by the Center for Community Progress, the Federal Reserve Bank of Atlanta, and the Federal Reserve Bank of Cleveland. It has been lightly edited and condensed for the web. In this chapter, John O’Callaghan, president and CEO of the Atlanta Neighborhood Development Partnership (ANDP), and Mandy Eidson, senior manager of the ANDP Loan Fund, share how ANDP is innovatively meeting affordable single-family housing needs in Atlanta. Click here to download the full chapter and read more insights on tackling vacancy and abandonment from the nation’s leading experts.

COVID-19 has spotlighted the deep racial inequities in housing and illustrated the importance of housing stability to protecting public health. Rising housing costs, supply gaps, and displacement risks facing longtime residents have been severely compounded by the pandemic, presenting new challenges for already disadvantaged residents and neighborhoods. Now more than ever, community development organizations are tasked with building organizational resilience to address growing housing challenges and deliver a scaled response to our nation’s dire housing needs.

Since its inception in 1991, the Atlanta Neighborhood Development Partnership, Inc. (ANDP) has been at the forefront of building scalable and replicable models for addressing systemic disparities through affordable housing development. In particular, the organization’s Foreclosure Response Program—launched in 2008 in direct response to the devastating foreclosure crisis—has proven a resilient model for affordable single-family development. This model is badly needed in cities like Atlanta, where the bulk of affordable housing is single-family and there is a sizeable homeownership divide and related wealth gap between Black and white households.

ANDP has adapted its single-family production strategies in response to changing market conditions and funding opportunities, enabling the organization to become a regional leader in rehabilitating and repopulating single-family homes for low- and moderate-income (LMI) households.

As new resources at the local and federal levels emerge to address affordable housing challenges, ANDP is increasing its efforts to further scale its production and mitigate the more recent impacts of the COVID-19 pandemic. Beginning in 2020, the organization has embarked on an unprecedented plan to preserve or build 2,000 units of affordable housing over the next five years, including 1,250 affordable multifamily units, 500 affordable homeownership units, and 250 single-family rental units.

Over the past 13 years, ANDP has developed a production model that prioritizes and links risk-sharing partnerships and leverages enterprise-level capital to achieve scale in developing affordable single-family housing. This work began in 2008 when ANDP shifted from being a primarily urban-focused multifamily housing developer to launching a large-scale Foreclosure Response Program focused on rehabilitating vacant and blighted single-family properties.

At the time, Georgia was facing the nation’s highest rate of bank failures, and Atlanta consistently ranked in the nation’s top metro areas for foreclosures. In response, ANDP’s board of directors unanimously voted to redirect all organization programming (housing development, lending, and advocacy) toward combating metro Atlanta’s devastating tide of foreclosures. Since that time, ANDP has increased its production of single-family housing from a six-home pilot to a pipeline now totaling over 700 homes benefiting LMI families, with 122 single-family units affected in fiscal year 2020 alone.

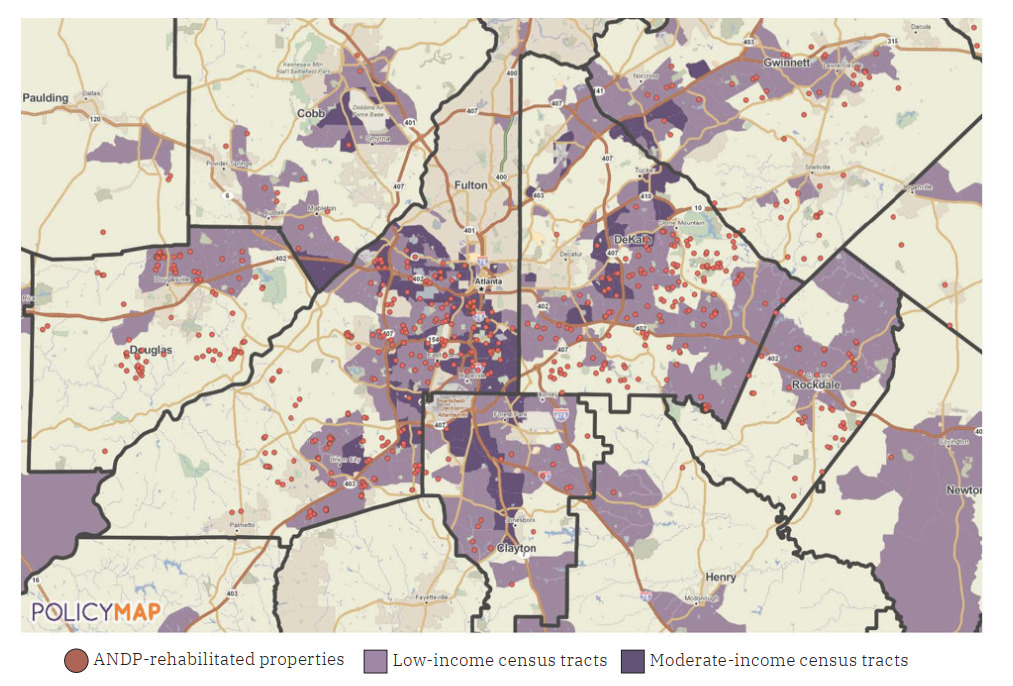

ANDP’s Foreclosure Response Program has achieved significant outcomes for residents and neighborhoods. Of the over 700 single-family units rehabilitated by ANDP as of June 30, 2020, the majority of ANDP’s production has been scattered throughout metro Atlanta, with a targeted focus on predominantly African American LMI communities south of Interstate 20 and along the Interstate 85 corridor. Residents in these areas were especially hard hit by the foreclosure crisis and suffered disproportionately from high rates of homeowner negative equity in its wake. In some suburban counties—where the poor population more than doubled from 2000 to 2015—ANDP has often been one of the few affordable housing nonprofits, and in some cases the only one, engaged in rehabilitating and repopulating single-family homes for LMI households.

ANDP’s work has primarily benefitted low-income families, first-time homebuyers, African Americans, and female heads of household. The program has served over 1,250 residents, including 483 children, with an average household income of $42,561, or 75 percent of area median income. Approximately 82 percent of ANDP’s homebuyers have received down-payment assistance to help reduce their home purchase costs, allowing families with limited savings to access homeownership and build equity. With an average home purchase price of $126,287, the majority of ANDP’s homebuyers have found homeownership to be more affordable than renting.

In addition to providing cost savings for LMI residents, ANDP’s single-family work has helped build resident and neighborhood wealth, restore lost homeownership levels, and enhance neighborhood stability in communities hit by the foreclosure crisis. Through studies commissioned in Douglas and DeKalb Counties, ANDP has found as much as a 15:1 leveraging effect for every dollar invested in home repairs, which helps lift property values in neighborhoods mired in negative equity and restore home equity among affected families. Furthermore, a 2019 study conducted by ANDP found that homebuyers who have been living in their homes or five years or longer have experienced $88,797 in average wealth gains through home price appreciation, down-payment assistance, and mortgage paydown. The study also found that 93 percent of ANDP’s homebuyers are still living in their homes, leading to greater neighborhood stability, lower student transiency rates, and improved educational outcomes.

Today, ANDP remains focused on developing affordable single-family homes in distressed neighborhoods and generating wealth for low-income families and families of color. The restoration of equity is of utmost importance in metro Atlanta, which currently leads the nation in income inequality and ranks second-to-last for upward mobility. Given the 10:1 wealth divide and 29 percent homeownership gap between White and Black households, expanding affordable homeownership opportunities for households of color is critical to addressing many of the pervasive racial disparities witnessed across our city and nation.

In the wake of the COVID-19 pandemic, the need for expanded affordable single-family homeownership and rental opportunities is even more pressing, particularly for low-income residents and families of color.

Disparities in health care outcomes and access contributed to vastly higher COVID-19 case counts among Black residents, who have also suffered more job and economic losses, putting them at greater risk of foreclosure and eviction. Furthermore, for-sale single-family housing inventory has declines, particularly in more affordable areas, where Black families face increased competition from other mortgage-ready households. Black workers have also had fewer chances to move to more affordable or higher-opportunity areas in COVID-19’s wake, given the remote work gap—only 20 percent of Black workers hold jobs that allow remote work, compared with 30 percent of white workers.

In metro Atlanta, ANDP has witnessed heightened demand among prospective LMI homebuyers as mortgage rates have decreased. However, the organization has experienced increasing difficulty in meeting demand because of rising development costs and a severe shortage of affordable inventory. Supply chain disruptions have led to significant increases in the costs of lumber and other materials and backlogs in the availability of household appliances. In the long term, this poses a risk for both developers of affordable single-family housing like ANDP and prospective LMI homebuyers in terms of creating untenable price increases. However, the risk that homebuyer sales will dip owing to broader macroeconomic conditions is mitigated in part by the fact that demand for affordable, quality, single-family homeownership and rental units is likely to continue to exceed supply, and the market will adjust correspondingly.

ANDP is drawing from the lessons it has learned over the past decade to remain nimble and responsive to ever-changing market conditions. The organization continues to test new product models, including lease-purchase, accessory dwelling units, new construction, and smaller homes, all with an eye toward reducing displacement, building minority wealth through homeownership, and improving the financial trajectory of LMI families. Working with experienced private development that can provide precise cost projections is also essential, as is continuing to raise low-cost, enterprise-level capital for new NMTC investments. Finally, ANDP’s growing single-family rental portfolio is providing additional security for the organization while preserving affordability in an otherwise uncertain housing market.

Although present-day housing challenges differ from those of the foreclosure crisis, many of the strategies implemented since have the potential to help address negative housing effects related to the COVID-19 pandemic. Funding, political willpower, and strategic leadership is needed now more than ever to avoid further entrenching existing disparities and reverse centuries-old inequities that threaten our nation’s most vulnerable residents and the shared communities we inhabit.

Get the latest tools, resources, and educational opportunities to help you end systemic vacancy, delivered to your inbox.