Challenges—and Opportunities—to Addressing Vacant Properties in Raton, New Mexico

September 20, 2023

This year, the Center for Community Progress had the honor of working with Raton, a rural community in northeastern New Mexico, to identify barriers and opportunities to tackling the city’s persistent vacant and abandoned properties. Our technical assistance team looked at: Why are there so many vacant and abandoned properties in Raton? Why is it so hard to do something about vacant properties in Raton? And what state and local policies will be the most important to change to facilitate vacant property reuse?

A snapshot of Raton

Raton is a case study in creative community resilience for southwest towns that have risen from industrial boom-and-bust cycles. Founded around 1880, Raton quickly became a regional hub for trading, ranching, and mining. The end of its major coal mining industry, beginning in the 1950s to the closure of the final mine in 2003, could have been a death sentence for the city. But local leaders of this fiercely independent town have leaned into a diversified economic strategy and taken advantage of the city’s proximity to the expanding I-25 corridor and its abundant commercial real estate to lure new businesses and industries. That includes the innovative El Raton Media Works, a nonprofit focused on bringing media projects to northern New Mexico and providing practical career training in film, television, and other media to youth and adults.

What is the vacant property problem in Raton?

Vacant properties in Raton can be attributed partially to a decline in population after the shuttering of its major industries. The city’s population has declined approximately 17 percent since the year 2000 alone.

Persistent vacant and abandoned properties can be attributed to a variety of factors. For example, some are owned by diffuse heirs who long ago abandoned the property or who do not even know they have a claim to a fraction of a property in Raton. Some are owned by out-of-state speculators who buy property sight unseen and without a plan for basic upkeep and maintenance, simply hedging their bets on the future of Raton. Other properties may be owned by locals who want to make a significant investment yet find themselves hamstrung given the value of the property is much less than the back taxes, other public debt, and the reasonable cost of repairs. In each scenario there are very few paths to removing these barriers.

To do something about vacant properties, a city first needs to know how many exist, where they are, and what condition they’re in. The City of Raton passed a Vacant Building Registration Ordinance (VBRO) in 2021 and began using a case management software to track code enforcement data. In the early months of Raton’s VBRO program, code enforcement staff identified over 200 vacant properties. This is a huge step to understanding the scale of the problem and the public costs of maintaining the status quo.

Why is it so hard to do something about vacant properties in Raton?

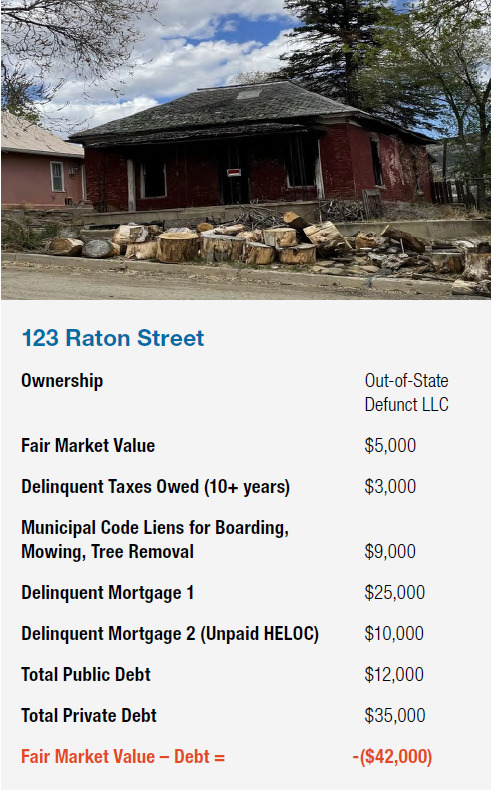

To better understand why it’s so difficult to address vacant properties, let’s examine a hypothetical house that exemplifies the type of problem property endemic throughout Raton and New Mexico.

Properties like “123 Raton Street” are not only eyesores and safety threats, the public and private debts they often carry render them inaccessible to responsible private buyers and well-intentioned public entities. This long-abandoned property has accumulated multiple years of property tax debt—lost municipal revenue—while the City has invested thousands of dollars in code, fire, and police dispatches to keep the property from harming neighbors. Banks long ago determined that the multiple mortgages in junior lien status on the property are uncollectible, not even worth the effort to complete a foreclosure given the public debts outweigh the fair market value of the property.

Though it is in an otherwise healthy neighborhood and could be the site of desperately needed affordable housing, 123 Raton Street remains stuck in legal and market limbo. The current fair market value of $5,000 is far less than the total public and private debt associated with the parcel. No reasonable and responsible private buyer would try to acquire it (if an owner can be located) because any private buyer would need to pay $42,000 simply to clean the debt—and that is before any investment to demolish the deteriorated structure and build a safe, new home for sale.

Challenges with delinquent property tax enforcement in New Mexico

Many communities across the country use the power granted to them in state law to foreclose on unpaid property tax and/or municipal lien debt on properties like 123 Raton Street. In a typical foreclosure, this public debt is given priority lien status and all prior liens or interests in the property are extinguished through the public foreclosure process. Then, the property is auctioned to a new owner.

Unfortunately, unlike in the vast majority of other states, New Mexico’s delinquent property tax enforcement process does not extinguish junior and uncollectible debt. As a result, no rational bidder would make an offer on 123 Raton Street at the annual Colfax County tax sale when the additional expense and time needed to satisfy those other debts outweighs the current or potential value of the property.

Raton could foreclose on the municipal liens associated with 123 Raton Street under existing New Mexico law. This would extinguish the junior and private debt and result in a sale of the property to a private bidder or a transfer to the City of Raton in the absence of one. However, there is no such local process for municipal lien enforcement in place. A process to engage municipal lien foreclosure requires significant involvement by real estate and local government attorneys, a robust municipal court system, and other capacities currently difficult to access in Raton.

Next steps to addressing vacant properties in Raton, New Mexico

Raton needs state and local policy reforms to truly address this inventory of problem properties hurting the community. Reforming New Mexico’s delinquent property tax enforcement process and creating a municipal lien enforcement process could extinguish junior and uncollectible debt and provide a pathway for new, responsible ownership.

Raton is not in this alone. Many communities in New Mexico face similar generational challenges related to industry and population lost, reflected in the vacant properties blanketing portions of the community. Building coalitions with cities like Albuquerque, which faces similar vacancy issues despite its larger population, is one key step to advocating for the state policy changes needed to benefit all New Mexico communities.

Finally, better data—counting vacant properties and tracking the costs they impose on city services—is critical. Using this data, a city like Raton, as well as any city struggling with vacant and abandoned properties, can make a stronger case to state leaders for funding and stronger laws that make it easier for communities to reclaim vacant properties. Read our full report to the City of Raton here.

If you’re struggling with vacant, abandoned, and deteriorated properties in your community, check out our free online resources, webinars, and publications. The Center for Community Progress also provides customized, expert guidance to state and local governments to assess the state of vacancy in your community and recommend policy and practice solutions for equitable neighborhood revitalization. Contact us at [email protected] to learn more!

Get the latest tools, resources, and educational opportunities to help you end systemic vacancy, delivered to your inbox.