|

|

How changes to Fair Market Rent affects access to affordable housing for extremely low-income rentersBy Frank MuracaPublished March 27, 2024Housing Choice Vouchers are a critical source of funding for North Carolina’s lowest income renters to access affordable housing. As of 2023, about 72,000 North Carolina renters use vouchers to subsidize the cost of rent and utilities. Of those renters, 73% are extremely low-income, earning less than 30% of the local area median income.[1] The program works by requiring voucher holders to pay a third of their income, while HUD covers the remaining portion of the housing costs. Landlords can choose to accept vouchers, which includes regular inspections to ensure the quality of the units and other administrative demands. Landlord participation in the voucher program has declined both nationally and in North Carolina from around 90% in 2018 to 80% in 2024. Some surveys suggest that one reason why landlords may be deterred from accepting vouchers is because they could lease units to non-voucher holders at rents that exceed the maximum subsidy covered by a voucher payment. “In Dallas, we show how motivation is shaped by market niche: landlords with older housing near the urban core have a strong motivation to participate,” researchers wrote in 2018, “but those in opportunity neighborhoods with high-quality housing have no trouble attracting reliable market tenants.” As a result, changes in the maximum allowable rent covered by a voucher – known as Fair Market Rents – can have significant impacts on extremely low-income renters’ ability to find units. How Fair Market Rents (FMR) are calculatedFair Market Rent is set at the 40th percentile level of gross rents for each metropolitan area and nonmetropolitan county. To determine FMR, the Department of Housing and Urban Development (HUD) uses the median rent price of 2-bedroom units from the latest American Community Survey (ACS). For instance, the 2024 FMR was calculated using ACS data from 2017 to 2021. HUD then adjusts these rents to current levels using the Consumer Price Index (CPI).[2] In recent years, economists have pointed out that the methodology for how the CPI measures changes in rent might not accurately capture the prices renters would see while looking for housing today. That’s because the rent data in the CPI is based on a survey that includes renters who have lived in the same unit for multiple years, and who are less likely to see the same price increases as a unit that turns over to a new tenant. As a result, the CPI tends to lag other rent indicators that are more heavily weighted towards what rents are being advertised for in a given time period. The implications of this difference are shown in Figure 1, which compares the Fair Market Rent and Zillow’s Rent Index for the Asheville, North Carolina MSA. Unlike FMR, Zillow’s rent estimates are based on changes in asking rents. In 2023, for instance, a voucher holder could rent a unit that costs up to $1,450 a month, while the median cost of rental units being advertised on the market was nearly $1,800 according to Zillow. In years when the gap between those two values is large, landlords may be less incentivized to rent their unit to a voucher holder when they could rent out that unit at a higher price. How FMR has changed to better reflect market realitiesBeginning in 2023, HUD changed its methodology to better address the CPI’s lag in rents by incorporating data from private parties such as RealPage and CoreLogic. These data sources tend to more closely reflect rents that are paid by new tenants, rather than tenants who are in the middle of a lease or who have re-signed an existing lease. Local governments can also play a role in ensuring that Fair Market Rents accurately reflect the prices that low-income renters see in the market. HUD allows Public Housing Authorities to conduct their own survey of rents and submit the data to use in place of the older data from ACS. For example, Figure 2 shows changes in FMR for a 2-bedroom unit in Transylvania County, North Carolina. FMR fluctuated between $650 and $700 a month, before jumping 32% in 2022. That year HUD began calculating FMR based on rent data collected and submitted by the local housing authority, rather than the lagged data that was available in the ACS. While it’s possible that rents did increase in Transylvania over that year, the jump that year is likely due to these changes in how the data was collected. This example – in addition to the methodology changes mentioned above – shows how improved data collection can help extremely low-income renters have better access to housing options in their communities. Housing Choice Vouchers are an important source of funding for low-income renters to access affordable housing but relies on landlord participation. To encourage this, HUD makes annual adjustments to the maximum housing costs (or Fair Market Rents) covered by the vouchers. Both HUD and local governments can play a role in ensuring Fair Market Rents accurately reflect market conditions by incorporating more up-to-date data than what can be captured by the Census. [1] U.S. Department of Housing and Urban Development. Picture of Subsidized Households. 2023. https://www.huduser.gov/portal/datasets/assthsg.html [2] For a full overview of FMR methodology in 2024, visit: Department of Housing and Urban Development. “Fair Market Rents for the Housing Choice Voucher Program, Moderate Rehabilitation Single Room Occupancy Program, and Other Programs; Fiscal Year 2024.” August 31, 2023. https://www.huduser.gov/portal/datasets/fmr/fmr2024/FMR_FY24_FinalNotice_2023.pdf |

Published March 27, 2024 By Frank Muraca

Housing Choice Vouchers are a critical source of funding for North Carolina’s lowest income renters to access affordable housing. As of 2023, about 72,000 North Carolina renters use vouchers to subsidize the cost of rent and utilities. Of those renters, 73% are extremely low-income, earning less than 30% of the local area median income.[1] The program works by requiring voucher holders to pay a third of their income, while HUD covers the remaining portion of the housing costs.

Landlords can choose to accept vouchers, which includes regular inspections to ensure the quality of the units and other administrative demands. Landlord participation in the voucher program has declined both nationally and in North Carolina from around 90% in 2018 to 80% in 2024.

Some surveys suggest that one reason why landlords may be deterred from accepting vouchers is because they could lease units to non-voucher holders at rents that exceed the maximum subsidy covered by a voucher payment.

“In Dallas, we show how motivation is shaped by market niche: landlords with older housing near the urban core have a strong motivation to participate,” researchers wrote in 2018, “but those in opportunity neighborhoods with high-quality housing have no trouble attracting reliable market tenants.”

As a result, changes in the maximum allowable rent covered by a voucher – known as Fair Market Rents – can have significant impacts on extremely low-income renters’ ability to find units.

How Fair Market Rents (FMR) are calculated

Fair Market Rent is set at the 40th percentile level of gross rents for each metropolitan area and nonmetropolitan county. To determine FMR, the Department of Housing and Urban Development (HUD) uses the median rent price of 2-bedroom units from the latest American Community Survey (ACS). For instance, the 2024 FMR was calculated using ACS data from 2017 to 2021. HUD then adjusts these rents to current levels using the Consumer Price Index (CPI).[2]

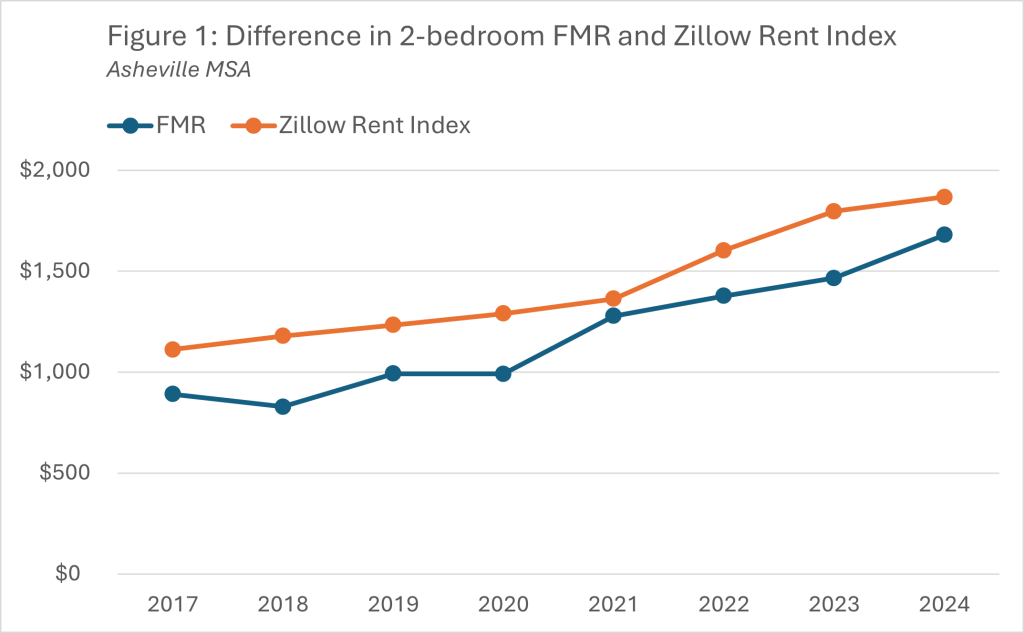

In recent years, economists have pointed out that the methodology for how the CPI measures changes in rent might not accurately capture the prices renters would see while looking for housing today. That’s because the rent data in the CPI is based on a survey that includes renters who have lived in the same unit for multiple years, and who are less likely to see the same price increases as a unit that turns over to a new tenant.

As a result, the CPI tends to lag other rent indicators that are more heavily weighted towards what rents are being advertised for in a given time period.

The implications of this difference are shown in Figure 1, which compares the Fair Market Rent and Zillow’s Rent Index for the Asheville, North Carolina MSA. Unlike FMR, Zillow’s rent estimates are based on changes in asking rents. In 2023, for instance, a voucher holder could rent a unit that costs up to $1,450 a month, while the median cost of rental units being advertised on the market was nearly $1,800 according to Zillow. In years when the gap between those two values is large, landlords may be less incentivized to rent their unit to a voucher holder when they could rent out that unit at a higher price.

How FMR has changed to better reflect market realities

Beginning in 2023, HUD changed its methodology to better address the CPI’s lag in rents by incorporating data from private parties such as RealPage and CoreLogic. These data sources tend to more closely reflect rents that are paid by new tenants, rather than tenants who are in the middle of a lease or who have re-signed an existing lease.

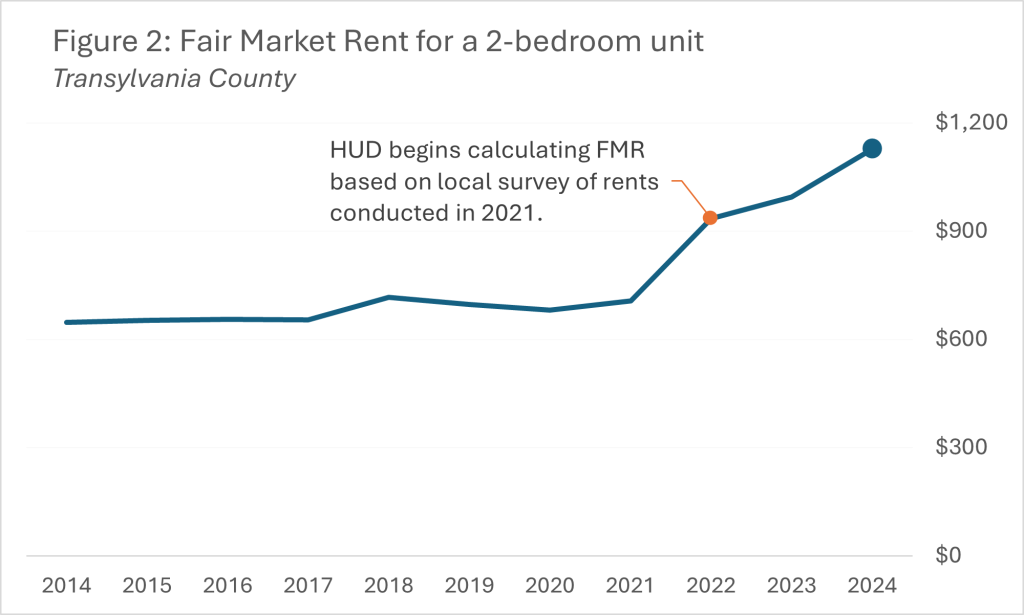

Local governments can also play a role in ensuring that Fair Market Rents accurately reflect the prices that low-income renters see in the market. HUD allows Public Housing Authorities to conduct their own survey of rents and submit the data to use in place of the older data from ACS.

For example, Figure 2 shows changes in FMR for a 2-bedroom unit in Transylvania County, North Carolina. FMR fluctuated between $650 and $700 a month, before jumping 32% in 2022. That year HUD began calculating FMR based on rent data collected and submitted by the local housing authority, rather than the lagged data that was available in the ACS. While it’s possible that rents did increase in Transylvania over that year, the jump that year is likely due to these changes in how the data was collected. This example – in addition to the methodology changes mentioned above – shows how improved data collection can help extremely low-income renters have better access to housing options in their communities.

Housing Choice Vouchers are an important source of funding for low-income renters to access affordable housing but relies on landlord participation. To encourage this, HUD makes annual adjustments to the maximum housing costs (or Fair Market Rents) covered by the vouchers. Both HUD and local governments can play a role in ensuring Fair Market Rents accurately reflect market conditions by incorporating more up-to-date data than what can be captured by the Census.

[1] U.S. Department of Housing and Urban Development. Picture of Subsidized Households. 2023. https://www.huduser.gov/portal/datasets/assthsg.html

[2] For a full overview of FMR methodology in 2024, visit: Department of Housing and Urban Development. “Fair Market Rents for the Housing Choice Voucher Program, Moderate Rehabilitation Single Room Occupancy Program, and Other Programs; Fiscal Year 2024.” August 31, 2023. https://www.huduser.gov/portal/datasets/fmr/fmr2024/FMR_FY24_FinalNotice_2023.pdf

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.