|

|

Recent Trends in Real Estate Development: Fall 2023By Frank MuracaPublished October 30, 2023

Lending for real estate development projects: interest rates & tighter lending standards In 2022, the Federal Reserve began raising interest rates to combat inflation, which increased the cost of financing new construction for real estate developments. In 2021, for example, a developer able to secure a $5 million loan with 3.5% interest to develop a new apartment building would have to pay approximately $300,000 a year in debt payments. With an interest rate of 8.5% today, debt payments on that loan would cost $483,000 a year, a 60% increase. In addition, the size of the loan would likely decrease due to the project’s inability to cover the higher debt service. According to one survey of the nation’s 30 leading apartment developers, 61% of projects were no longer economically feasible in June 2023, up from 18% in March 2022 right before the Federal Reserve began increasing rates.[1] In September, 73% of surveyed apartment builders reported that projects were delayed due to the availability of financing, or loans to pay for the cost of construction. One reason why lending has declined is because lenders have tightened their credit standards. Figure 2 shows survey response data from the Federal Reserve’s Senior Loan Officer Opinion Survey (or SLOOS). The survey asks banks whether they are tightening standards for commercial real estate loans used for construction or land development. According to one analysis from First American Bank, “The percentage of banks reporting tighter lending standards picked up for all types of loans, but this figure was highest for construction loans at 72 percent…This is a complete shift in lending standard trends compared with two years ago, when interest rates were low and banks were reporting looser, rather than tighter standards.” Changes in construction costs In addition to the availability of lending, the cost of building materials continues to be between 30% and 45% higher than pre-COVID prices. In January 2023, one construction company official told WBTV, “COVID really started really inflating prices for construction, for a lot of different materials and that was really the start of it, and now inflation after that has kept prices kind of high, so it’s been probably about 2-years now.” Even with recent reduced inflation, constructions costs have not declined. There should be stabilization across most raw materials, but construction costs are not expected to decline (they rarely do). Taking the long view, the COVID surge in construction prices was the fastest and most significant cost increase since the Federal Reserve started recording this data in 1947.[2] While prices have moderated since their peak in 2022, they remain about 42% above pre-COVID levels. Some North Carolina communities have had to cover rising construction costs for affordable housing projects. Earlier this year, Raleigh and Wake County approved an additional $2.3 million to cover the costs of a 156-unit development in northeast Raleigh. Last year, the City of Durham allocated additional funds for a 72-unit development that faced increased construction costs. Frank Muraca is a Senior Real Estate Development Analyst with the UNC School of Government’s Development Finance Initiative (DFI). Rory Dowling, DFI Development Advisor, is a co-author of this post. [1] St. Louis FRED Economic Data. Producer Price Index by Commodity: Special Indexes: Construction Materials. https://fred.stlouisfed.org/series/WPUSI012011 [2] Source: National Multifamily Housing Council. Quarterly Survey of Apartment Construction & Development Activity (September 2023). https://www.nmhc.org/research-insight/nmhc-construction-survey/2023/quarterly-survey-of-apartment-construction-development-activity-september-2023/ |

Published October 30, 2023 By Frank Muraca

This blog post is the first in a regular series aimed at informing local government partners about current conditions facing private developers and development projects in their communities.

This blog post is the first in a regular series aimed at informing local government partners about current conditions facing private developers and development projects in their communities.

Lending for real estate development projects: interest rates & tighter lending standards

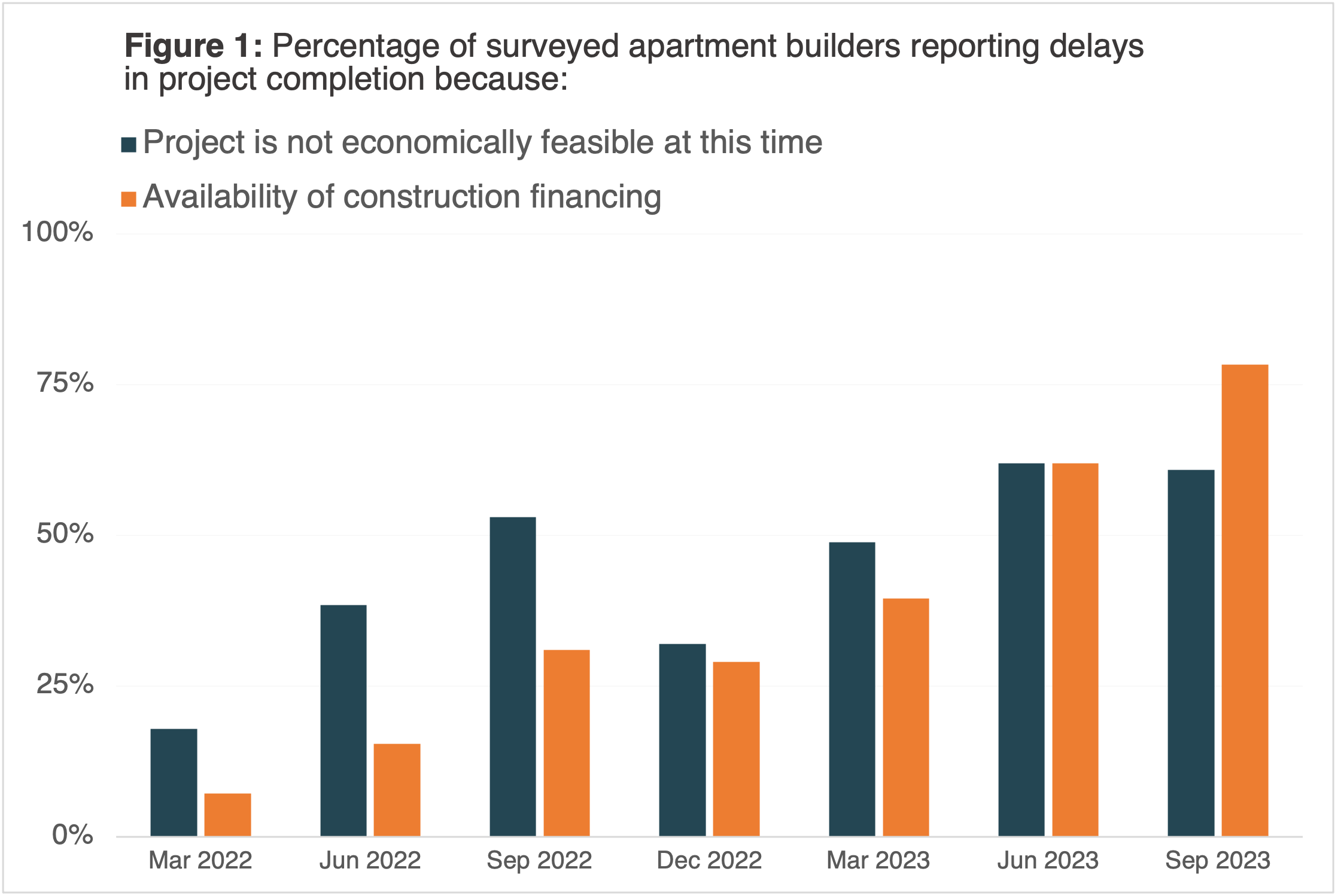

In 2022, the Federal Reserve began raising interest rates to combat inflation, which increased the cost of financing new construction for real estate developments. In 2021, for example, a developer able to secure a $5 million loan with 3.5% interest to develop a new apartment building would have to pay approximately $300,000 a year in debt payments. With an interest rate of 8.5% today, debt payments on that loan would cost $483,000 a year, a 60% increase. In addition, the size of the loan would likely decrease due to the project’s inability to cover the higher debt service. According to one survey of the nation’s 30 leading apartment developers, 61% of projects were no longer economically feasible in June 2023, up from 18% in March 2022 right before the Federal Reserve began increasing rates.[1]

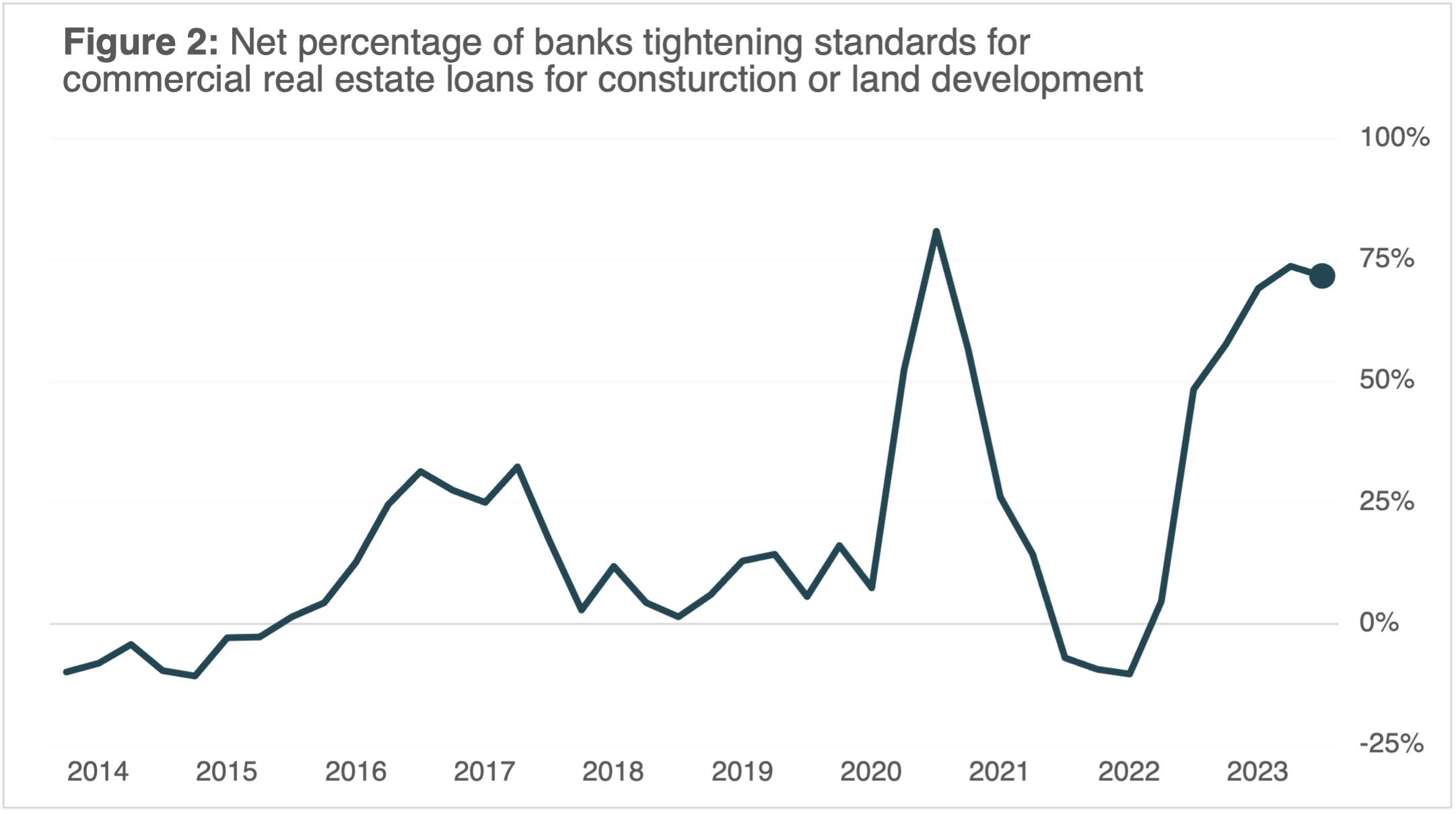

In September, 73% of surveyed apartment builders reported that projects were delayed due to the availability of financing, or loans to pay for the cost of construction. One reason why lending has declined is because lenders have tightened their credit standards.

Figure 2 shows survey response data from the Federal Reserve’s Senior Loan Officer Opinion Survey (or SLOOS). The survey asks banks whether they are tightening standards for commercial real estate loans used for construction or land development. According to one analysis from First American Bank, “The percentage of banks reporting tighter lending standards picked up for all types of loans, but this figure was highest for construction loans at 72 percent…This is a complete shift in lending standard trends compared with two years ago, when interest rates were low and banks were reporting looser, rather than tighter standards.”

Changes in construction costs

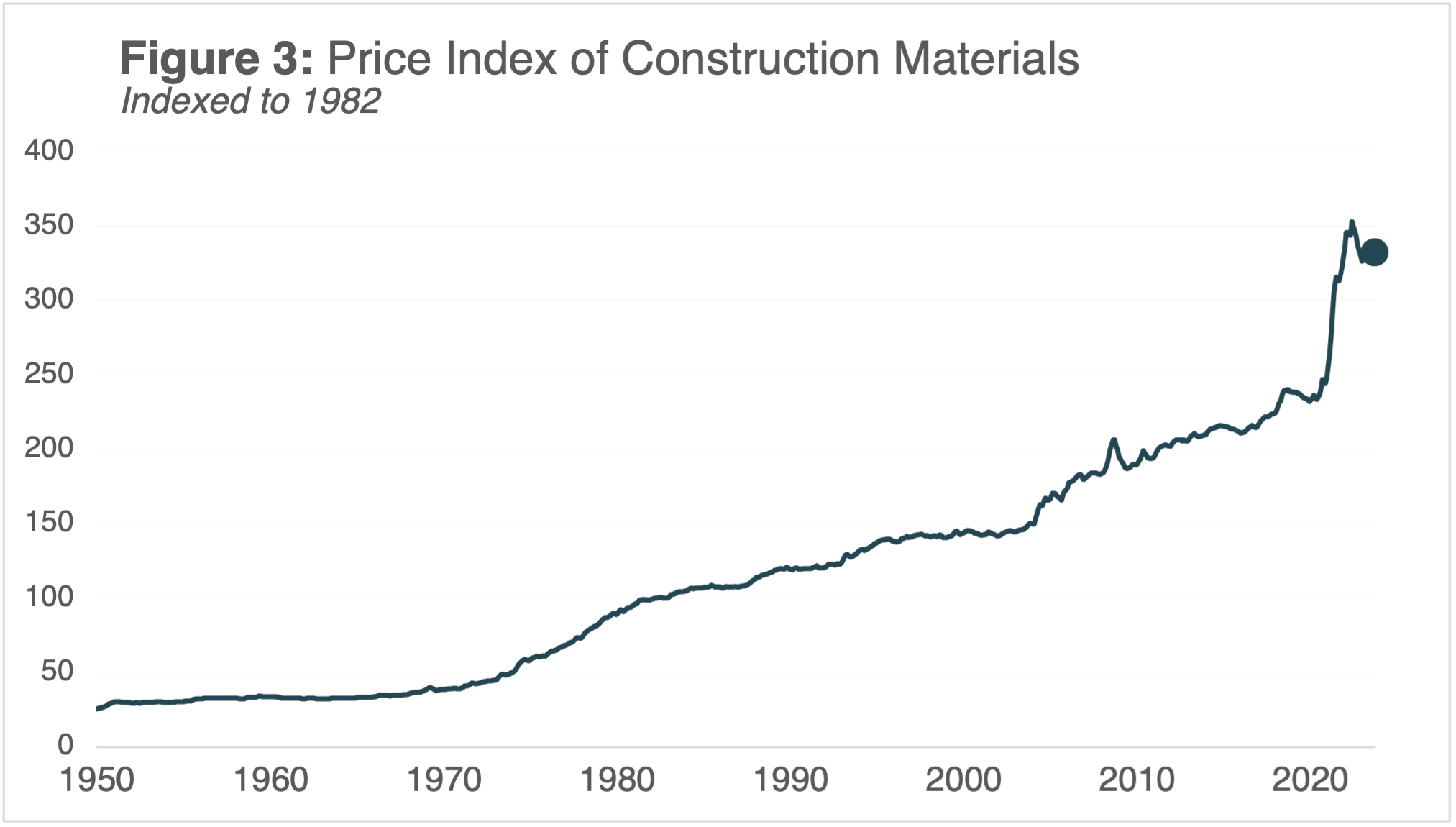

In addition to the availability of lending, the cost of building materials continues to be between 30% and 45% higher than pre-COVID prices. In January 2023, one construction company official told WBTV, “COVID really started really inflating prices for construction, for a lot of different materials and that was really the start of it, and now inflation after that has kept prices kind of high, so it’s been probably about 2-years now.” Even with recent reduced inflation, constructions costs have not declined. There should be stabilization across most raw materials, but construction costs are not expected to decline (they rarely do).

Taking the long view, the COVID surge in construction prices was the fastest and most significant cost increase since the Federal Reserve started recording this data in 1947.[2] While prices have moderated since their peak in 2022, they remain about 42% above pre-COVID levels.

Some North Carolina communities have had to cover rising construction costs for affordable housing projects. Earlier this year, Raleigh and Wake County approved an additional $2.3 million to cover the costs of a 156-unit development in northeast Raleigh. Last year, the City of Durham allocated additional funds for a 72-unit development that faced increased construction costs.

Frank Muraca is a Senior Real Estate Development Analyst with the UNC School of Government’s Development Finance Initiative (DFI). Rory Dowling, DFI Development Advisor, is a co-author of this post.

[1] St. Louis FRED Economic Data. Producer Price Index by Commodity: Special Indexes: Construction Materials. https://fred.stlouisfed.org/series/WPUSI012011

[2] Source: National Multifamily Housing Council. Quarterly Survey of Apartment Construction & Development Activity (September 2023). https://www.nmhc.org/research-insight/nmhc-construction-survey/2023/quarterly-survey-of-apartment-construction-development-activity-september-2023/

Author(s)

Tagged Under

This blog post is published and posted online by the School of Government to address issues of interest to government officials. This blog post is for educational and informational Copyright ©️ 2009 to present School of Government at the University of North Carolina. All rights reserved. use and may be used for those purposes without permission by providing acknowledgment of its source. Use of this blog post for commercial purposes is prohibited. To browse a complete catalog of School of Government publications, please visit the School’s website at www.sog.unc.edu or contact the Bookstore, School of Government, CB# 3330 Knapp-Sanders Building, UNC Chapel Hill, Chapel Hill, NC 27599-3330; e-mail sales@sog.unc.edu; telephone 919.966.4119; or fax 919.962.2707.